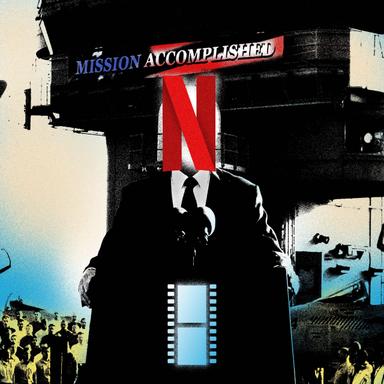

Last year, when asked about the multiplex phenomenon “Barbenheimer,” Ted Sarandos didn’t mince his words. “They definitely would have enjoyed just as big an audience on Netflix,” the CEO of the streaming giant said, dismissing Barbie’s and Oppenheimer’s box office success as any kind of proof that the movie theater experience was bouncing back after a paradigm-shifting pandemic. Even if there was truth to Sarandos’s logic—namely, that just as many people would have eventually watched those movies on Netflix—it came across as bitter and defensive. You had to laugh at the bluster.

But who’s gotten the last laugh? On Friday, news broke that Sarandos and his company had won the bidding war for Warner Bros., the storied Hollywood studio behind some of the most beloved movies ever made—including, yes, Barbie. For the significant sum of $82.7 billion (more than anyone’s ever spent to buy a studio), Netflix stands to gain control of not just the Warner Bros. name, library, and intellectual property, but also HBO and competing streamer HBO Max. (Discovery, CNN, and the other basic cable networks under the Warner umbrella will be sold as separately as Barbie accessories, at least under the tentative Netflix arrangement.)

It isn’t a done deal yet. On Monday morning, David Ellison, CEO of the newly formed mega-studio Paramount Skydance, announced that he’s attempting a hostile takeover of Warner Bros. by appealing directly to shareholders. Ellison, son of billionaire Trump booster Larry Ellison, was considered the likeliest new owner of WB until a series of lowball offers opened the door to other bidders, including Comcast (which already owns Universal) and Netflix. Coincidentally or not, Ellison’s announcement followed a statement by President Trump in which he called Netflix’s coup a potential “problem” and signaled that he might marshal regulatory forces against the historic deal. That was not Trump’s tack when it came to Skydance’s successful purchase of Paramount earlier this year, which may explain why in the aftermath, Ellison has already reshaped CBS News to the whims of the White House. (And the thinking is that he’d do the same to CNN.)

But Netflix seems ready for a fight, admitting that it could take upward of 18 months to close the deal. Whatever relief people have felt about Ellison’s failed (at least for now) bid has been drowned out by alarm bells sounded by Hollywood unions, A-list producers, and lawmakers on both sides of the aisle. Many see a major monopoly in Netflix’s success, one that could reshape the entire entertainment industry and give the world’s leading streaming service an even larger advantage in the fight to become the only game in town.

At this early stage, the story of the deal could still take a thousand turns. But for now, the unthinkable seems likely: Netflix, famous foe of the old studio system, will gain control of one of the last standing dream factories. The trickle-down effects could be profound.

The movie theater model could further transform.

Among the various groups opposing this deal is an anonymous collective of Hollywood producers who sent a letter to Congress in hopes of scuttling it. “Netflix views any time spent watching a movie in a theater as time not spent on their platform,” the letter states. “They have no incentive to support theatrical exhibition, and they have every incentive to kill it.” This isn’t baseless anxiety. Netflix has never hidden its ambition to effectively render theaters obsolete. Sarandos himself called them “outdated,” making the case that because most Americans can’t simply walk to their local movie house, they are somehow inaccessible.

The platform has always been the thing for Netflix. (Editor's note: The Ringer recently partnered with Netflix to host certain podcasts on the service.) When its movies reach theaters, it’s for a brief time—to qualify for awards or to appease filmmakers not so keen to see their babies relegated solely to streaming. Glass Onion, the Knives Out sequel Netflix distributed in 2022, did well enough during its single-week theatrical run to have many wondering whether Netflix was leaving money on the table by not leaving it in multiplexes. But such speculation misses the larger point: For Netflix, no box-office returns are worth keeping the product from landing in one place for one monthly fee. It is not in the exhibition business. It is in the subscription business.

For now, Sarandos is promising not to disrupt the theatrical plans of the Warner Bros. slate. But even his assurances are couched in qualifying language, with talk of “evolving” release strategies and meeting “the audience where they are.” You don’t need to be a seasoned entertainment reporter to read between the lines: The window separating the theatrical release and streaming debut of Warner titles—which has already steadily shrunk over the past few years—will likely get smaller still, as Netflix further prioritizes home viewing over the big-screen experience.

Should the other majors follow Netflix’s lead in shortening theatrical engagements, this could push movie theaters from struggling to downright endangered. Gone will be the word-of-mouth sensation, robbed of the runway to build a healthy box-office haul over time. And with the promise of new movies dropping on streaming shortly after they hit theaters, the number of viewers deciding to simply wait until they’re available at home may grow to an unsustainable level for some theaters to stay in business.

If Christopher Nolan thought that Warner was betraying the theater industry before, wait until he sees the studio under Netflix’s command.

Your favorite movies might get harder to watch.

If the Warner acquisition goes through, Netflix won’t just decide the future of one of Hollywood’s oldest studios. It’ll also control that studio’s past, in the sense that the streamer will gain access to roughly a century of beloved classics … and the power to grant or limit access to those movies as it sees fit. Netflix being Netflix, that probably means they’ll become exclusively available to monthly subscribers—although not necessarily Netflix subscribers, as Sarandos is promising, at least for now, to keep HBO Max a discrete service.

Of course, there’s more at stake than one studio’s back catalog, however vast and beloved it may be. The Netflix-Warner deal could have larger consequences for how we watch movies and for the matter of ownership in the streaming age. Mike Flanagan, the creator of the bingeable Netflix limited series The Haunting of Hill House, broached the topic a couple of years ago when he complained about the streamer’s disinterest in putting its originals out on Blu-ray. What happens, he wondered, if those movies and shows disappear from the platform? We’ve already seen this happen on HBO Max itself, when Warner Bros. Discovery removed dozens of titles such as Westworld, Love Life, and The Time Traveler’s Wife from the service. Without what used to be called a home-video release, movies and TV series could become indefinitely unavailable.

As the line separating streaming services and movie studios blurs, physical media could become even more of a boutique industry than it is today. And more of a necessity for the true movie lover, too. In a world of shrinking streaming libraries, the only way to truly preserve a beloved favorite is to own a copy. In other words, hold on to those Goodfellas discs. And buy Sinners while you still can.

It’s not TV. It’s Netflix.

Forget the streaming wars. In absorbing HBO—its longtime Emmy rival and the premium-cable leader with which it’s been so often compared—Netflix has arguably prevailed over traditional broadcast television itself. Will the streamer rebuild the small screen in its own image?

That might be a less than comforting thought for TV creators and TV watchers alike. After all, the streamer has developed a reputation for inscrutably ruthless renewal practices—a habit of canceling buzzy apparent sensations like Glow and Mindhunter just as they’re finding their audience or hitting their stride. In fact, it’s practically a running gag that you shouldn’t get too attached to a Netflix show because it almost certainly won’t last longer than three seasons.

While traditional TV has always looked to Nielsen ratings (a perhaps outdated model) as a way to parse the hits from the flops, Netflix’s decision-making has rarely been so clear-cut. It’s said to be driven almost entirely by complex internal data—an algorithmic approach to programming that’s technically scientific but can look like a maddening whim from the outside. It’s kept the streamer profitable while sometimes alienating both talent and subscribers.

Will this be the new direction for HBO? The network became the most trusted name in prestige TV by not always letting raw viewership numbers determine a show’s fate. It’s hard to imagine an acclaimed minor ratings success like Succession making it four seasons under Netflix leadership. The irony is that a company that’s long attracted subscribers with its acquired library titles could cut off one of its best sources of them by taking the reins of HBO itself.

David Zaslav gets richer.

David Zaslav’s tenure at WBD has made him one of the most hated men in Hollywood: He’s shelved finished films for tax write-offs, gutted streaming libraries and the beloved Turner Classic Movies, and shrugged off lucrative, long-standing partnerships with artists like Nolan and Clint Eastwood (whose latest and maybe final film, Juror #2, was treated like a glorified Max Original). For some, the silver lining in all this news would be the mogul getting the boot from the company he’s ruthlessly run these past few years. But there’s no word yet on whether Netflix plans to replace him.

Even if it opts not to retain him, he stands to make a mint off the Netflix deal, whether it goes through or not. His huge stock portfolio could usher him into the billionaires club by January—an unfortunate windfall for a CEO who’s probably the most anti-labor, anti-art executive in Hollywood.

Fewer jobs, fewer projects.

News of the Warner deal has sent ripples of disapproval through an industry currently experiencing a historic downturn in production. On NPR on Monday, Matt Belloni, host of The Ringer's The Town podcast, called the merging companies “two of the bigger buyers,” emphasizing that both Netflix and Warner have generated jobs at a time when everyone in Hollywood needs a job. “And the fear is that it would cause one of them to either go away completely or be severely diminished.” No wonder the DGA, WGA, and SAG have all publicly expressed their concerns.

Canceled projects and slimmer slates are to be expected when one movie studio swallows another. Just look at what happened to 20th Century Fox after the Disney takeover: A one-time giant of the business was reduced to a phantom limb as the Mouse House picked the corpse clean for available IP while giving tons of projects already in the pipeline the unceremonious ax. Acquisitions tend to lead to layoffs, too. They certainly have at Paramount, where Ellison sliced and diced about 10 percent of the workforce back in October.

There’s no version of this sale that doesn’t end with two giant companies effectively becoming one. If Warner doesn’t end up getting assimilated into the Netflix machine, it’ll likely instead combine with Paramount or Universal. All outcomes signal that Hollywood, like so many other industries, is falling under the shadow of a small handful of giant companies. The classic studio system is gone. With it go future films and the steady incomes they create.

When companies combine, the customer loses.

Here’s one thing you can count on: Your monthly Netflix subscription fee will almost certainly go up if this deal goes through. That would happen anyway, of course—it just did back in January. But future price hikes could be more significant if the world’s most popular streaming service sees its market share climb even higher. Whether Netflix ends up drafting Harry Potter and Batman into its own library or offering a bundle that includes HBO Max, an increase is probably inevitable.

As former Warner Bros. CEO Jason Kilar tweeted a few days ago, the Netflix-Warner deal is the “quickest way to reduce competition in Hollywood”—a very bad thing, by his estimation. Competition is what keeps rates lower. It’s one of the key tenets of the anti-monopoly laws Netflix will have to try to circumvent. If the streamer is successful, prices will (continue to) rise as Netflix moves closer to its ultimate goal of being the only entertainment provider you need. Because what else are you going to do, subscribe to a different service? When it’s Netflix or nothing, the sky’s the limit on how much it can charge.

Without competition, the future of art and entertainment narrows. It creates an environment where an increasingly small group of people decides what projects get funded and what movies and TV shows we get to see. Disney’s decimation of Fox is but one example. Another is the way the Weinsteins controlled the indie market in the ’90s and beyond, buying up loads of films from the festival circuit, sometimes specifically just to shelve them and keep them out of competitors’ hands.

But competition can be creatively fruitful. One wonders whether Netflix would even invest in art-house filmmakers the way it has over the years—handing big budgets to Martin Scorsese, Guillermo del Toro, and more—if there were no other studio forcing it to. For more than a century, some of the greatest movies ever made have risen out of an endless jostling for the public’s dollars and attention. Hell, Barbenheimer is a product of such a rivalry: an organic double-feature event that grew out of two studios playing chicken over a release date and neither blinking. We had a choice between both, and we chose both. Be wary of a future where there’s no choice at all.