In the penultimate episode of Yellowstone, horse trainer and trader Travis Wheatley, played by Taylor Sheridan, tries to up the price for a horse he’s putting through its paces. He sets the starting price at $2 million, but just as his Brazilian buyer is about to bite, Travis tells him that his other buyers (whom Travis has wholly invented) are willing to go to $2.1 million. “You didn’t say ‘other buyers,’” the Brazilian objects. Wheatley counters, “Well, when you go shopping for a house, do you think you’re the only one fucking shopping?” Suddenly feeling the heat, the Brazilian bids $3 million, and he has himself a (pricey) deal.

Sheridan, who created and wrote Yellowstone and its galaxy of spinoffs, may be as adept at selling himself as Wheatley was at auctioning off thoroughbreds. The prolific 55-year-old TV creator and moviemaker recently landed a large deal of his own—and not with his longtime partner, Paramount. There were other buyers for his work as well.

In August, just as Sheridan and Paramount Pictures teamed up on an enormous new studio facility in Texas, the chairman and CEO of the newly merged Paramount Skydance, David Ellison, told CNBC that he planned to be in business with Sheridan indefinitely. “I have a really good relationship with Taylor, and I think he is literally a singular genius and content creator,” Ellison said, adding, “he literally has a perfect track record. And so, from that standpoint, I’m thrilled that we have an exclusive deal with him through 2028. And my goal is to have Taylor call Paramount his home for as long as he wants to be telling stories.”

That goal was thwarted because Paramount wasn’t the only one fucking shopping for what Ellison referred to as Sheridan’s “best in class” content. As first reported by Puck on Sunday night, Sheridan is saddling up and preparing to depart Paramount when his current TV contract concludes at the end of 2028. On January 1, 2029, Sheridan will begin a five-year TV overall deal at NBCUniversal, ending a productive decade of pumping out Paramount-funded/distributed TV dating back to the premiere of Yellowstone in June 2018. The first stage of Sheridan’s uncoupling with Paramount will start even sooner: Per Puck’s Matthew Belloni (who also hosts Ringer podcast The Town), Sheridan also signed an eight-year movie deal with NBC that will start when his big-screen pact with Paramount expires next March. Sheridan’s producing partner David Glasser and his 101 Studios will likewise make the leap from Paramount to NBC early next year.

In August, Paramount streaming head Cindy Holland praised “the Taylor Sheridan universe” as “a really great foundation” for Paramount+. Now, that foundation—or, at least, its architect—is leaving for a rival. Perhaps Paramount should have heeded the wisdom of Yellowstone patriarch John Dutton: “It’s the one constant in life. You build something worth having, someone’s gonna try and take it.”

Aside from forcing Sheridan fans to visit Peacock (which, weirdly, was already Yellowstone’s streaming home) when they want to watch Sheridan’s future small-screen work, what are the implications of the actor-writer-director-producer-rancher’s surprising move? In a nod to Sheridan’s 6666 ranch, vodka brand, and possible Yellowstone spinoff, let’s examine six implications of the megadeal.

1. There are limits to Paramount’s IP possessions.

Since the $8.4 billion merger of Paramount and Skydance closed in August—shortly after Paramount ingratiated itself with Donald Trump by first settling a lawsuit Trump had filed over the editing of a Kamala Harris interview on 60 Minutes, and then canceling The Late Show With Stephen Colbert—Paramount has been on a buying spree. “David Ellison Is Moving Fast and Spending Big to Remake Hollywood,” the headline of a Wall Street Journal article proclaimed last week, echoing a New York Times story from September (“David Ellison’s Hollywood Plan: Lights … Camera … Spend!”). Ellison has lavished a fortune on UFC and a smaller fortune on South Park; lured the Duffer brothers away from Netflix; bought The Free Press; and landed movies from Will Smith, James Mangold, and Timothée Chalamet (High Side), Activision (Call of Duty), and Legendary (Street Fighter).

Ellison’s acquisition spree is still in progress: Paramount has made multiple bids for Warner Bros. Discovery, which have thus far been rebuffed. Evidently, not everything Paramount sets its sights on can be bought—even when Ellison puts a premium on it, as he seemed to do with Sheridan.

NBC broke the bank to add Sheridan, reportedly committing to spend as much as $1 billion on his deal, depending on his output, or “about double” what his current deal at Paramount pays him. However, Ellison may not have been beaten based on dollars alone. According to Belloni, “the money wasn’t the big factor” in Sheridan’s decision. Rather, a confluence of factors seems to have convinced Sheridan that the grass (and money) was greener on the NBC side.

Ellison’s takeover has led to a lot of upheaval in the Paramount C-suite, as Holland and some of her hires from her former home at Netflix have replaced executives who worked closely with Sheridan. Belloni mentions that “behind the scenes, Sheridan was hearing about how Paramount+ needed to be revamped, and about how expensive his shows had become.” The prospect of increased oversight or budgetary belt-tightening couldn’t have thrilled someone who’s accustomed to getting his way as often as Sheridan has, and Ellison and Holland reportedly ruffled his feathers further by buying a new show featuring Nicole Kidman (which could affect her availability for Lioness) without giving him a heads-up and by trying to insert Paramount into a distribution deal for a film Sheridan wrote in his pre-Paramount days.

It's possible that Paramount’s limitless ambitions were a turnoff for Sheridan, who appears to have been a priority, but not the priority, for the company. According to Deadline, Sheridan “felt dismissed” to some degree, and although Ellison and his lieutenants made some effort to woo Sheridan, they reportedly never made him an extension offer. Belloni notes that while Ellison is attempting to “create a massive, Netflix-like player in the streaming wars, Sheridan can again become the very big fish in a smaller pond. And while the major streaming players have moved years in advance to lock in proven properties like the NFL and the Grammys, NBCU is treating Sheridan like its own franchise play.”

Of course, no one knows better than Paramount how powerful a franchise Sheridan can be, which brings us to our next takeaway.

2. Losing Sheridan may slow Paramount’s streaming momentum.

Paramount is still, at most, a modest player in the crowded streaming space. Per Nielsen’s latest viewership report, Paramount+ and the Paramount-owned Pluto TV combined account for about 2 percent of streaming viewership—a pittance compared with behemoths YouTube and Netflix and perhaps half what Disney and Amazon pull. On its own, Paramount+ has roughly the same reach as HBO Max or, more relevant to Sheridan, Peacock. But Paramount+ has been on the upswing from a viewership perspective, thanks in no small part to Sheridan’s many Nielsen-charting shows: not just Yellowstone and spinoffs 1883 and 1923 but also Lioness, Landman, Lawmen: Bass Reeves, Mayor of Kingstown, and Tulsa King.

The Entertainment Strategy Guy, a former streaming executive who analyzes the streaming landscape on Substack, recently lauded the high hit rate of the “underrated” streamer’s scripted offerings, in contrast to Peacock’s paltry slate. “Compared to NBCUniversal, which sometimes almost looks like it’s going to get out of scripted programming entirely in favor of sports, Paramount is trying to do both,” he wrote. “I love it.”

NBCUniversal is reportedly trying to add MLB to a sports portfolio that already includes the NBA and WNBA, but its signing of Sheridan proves that it’s aiming to stay in scripted content, too. It also seems to clarify whether parent company Comcast is, as Puck put it, “a buyer or a seller in the current media M&A wars.” As Belloni observed, “Poaching Taylor Sheridan suggests [NBCU] at least intends to compete at the highest level.” But what impact will Sheridan’s decision to pull up stakes have on Paramount’s aspirations?

Earlier this month, the Entertainment Strategy Guy pointed out that NCIS spinoff Tony & Ziva had charted on Nielsen in its first week, “a sign of growth for Paramount+,” but that it “may not be a Taylor Sheridan-sized hit.” If it were, the ESG said, “Paramount might be on their way to a third column of content to rely on.” The two existing columns are Sheridan shows and Star Trek, but both are looking a little wobbly. Paramount’s Star Trek series replicator may be on the fritz: Strange New Worlds will end after its fifth season, and only one upcoming series, Starfleet Academy, has been announced. Paramount seems uninterested in making more Trek TV movies, following the failure of the execrable Section 31, and the future of the theatrical film franchise is still inscrutable.

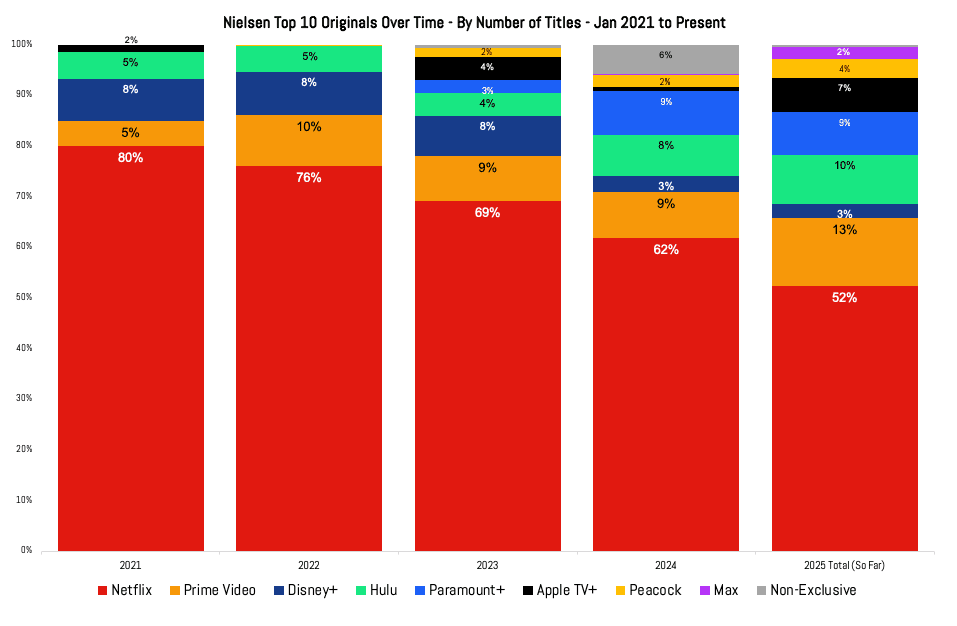

Now Sheridan is taking his TV talents elsewhere, which could put a crimp in Paramount’s developmental pipeline and jeopardize its growth. In July, the ESG published a breakdown by streamer of Nielsen top 10 originals over time, which showed that Paramount+ had been “the big winner in recent years.”

It's not that the cupboard has been bare outside of Sheridan’s shows—those top-10 entries have included MobLand, Tony & Ziva, and Strange New Worlds this year and Knuckles, Halo, Star Trek: Discovery, and SEAL Team in 2024—but he has driven an outsize portion of Paramount’s streaming glow-up. After all, Paramount has aired new episodes of as many as four Sheridan shows on the same day, a phenomenon I dubbed a “Taylor Sheridan equinox.” Deadline reported that Sheridan “plans to create 20 shows” for NBC. That’s a wealth of content that won’t be Paramount property.

I asked the ESG for his initial reaction to Sheridan’s decision to change horses in midstream(er). “I don't like grabbing a person on their second deal, for NBC, as [Sheridan still has] a lot of work at the old home,” he told me via email. “But when it comes to legitimate hit makers, he and Shonda [Rhimes] are tied for first right now in my book. So Paramount letting him go seems like a pricey mistake!”

3. Paramount can try to take the “Sheridan” out of the “Sheridan universe.”

Speaking of Sheridan’s work at his old home! One aspect of Sheridan’s departure makes it more palatable for Paramount: The “Sheridan universe” will likely outlive Sheridan. As The New York Times noted, “Any series that Mr. Sheridan creates or produces over the next three years will be controlled by Paramount, and the company will own any future episodes produced for ongoing series as well.”

That might mean that the likes of Lioness, Landman, Mayor of Kingstown, and Tulsa King could continue at Paramount even after Sheridan exits, in addition to Yellowstone spinoffs Y: Marshals (which is slated to premiere on CBS next year), The Madison (which started filming in 2024), The Dutton Ranch (which is well into the casting phase), and, perhaps, 1944 and 6666. Presumably, Yellowstone characters or concepts could be mined for more series down the road even without Sheridan’s sign-off. (As could other Sheridan shows: Tulsa King spinoff NOLA King, starring Samuel L. Jackson, is scheduled to enter production next year.) Thus, he’ll be the gift that keeps giving even after he’s gone. As Belloni wrote, “Maybe Paramount will have extracted all the value its new leaders need out of Sheridan by 2028.” Paramount may believe that NBC bought high.

Plus, Sheridan has more than three years left on his TV deal, during which time he could make more shows—although Paramount passed on a show of his called The Correspondent, described as a drama about “a war correspondent on the front lines of Afghanistan,” which was once tentatively lined up for 2026. The timing of Sheridan’s exit creates an awkward dynamic. His decamping for NBC so far in advance is a little like a soccer striker or Formula One driver agreeing to join a new team while still suiting up for its direct rival—in that his present production makes him a competitor to his future full-time employer. Per Puck, “He is said to carry very specific output requirements in his current deal,” so it’s not as if he can quiet quit or focus fully on his moviemaking. (He also doesn’t seem wired to want to coast until 2029, as a believer in Beth Dutton’s third way to get rich.) But it wouldn’t behoove him to blow through his best TV ideas now, knowing he’d have to surrender control of them in a few years.

The catch in Paramount’s possible plan to produce Sheridan shows without Sheridan is that their creator has been so integral to their operation. As he once said, “For me, writers rooms, they haven’t worked. … If I have to check in creatively with others for a story I’ve wholly built in my brain, that would probably be the end of me telling TV stories.” I’m generally pro–writers rooms, but I can’t quibble with the results of Sheridan’s self-sufficient style. He has a writing credit on every episode of Yellowstone, including sole credit on every episode starting with Season 3. He also wrote every episode of 1883 and 1923 single-handedly, as well as all but one episode of Lioness. Sheridan told THR that he can crank out an episode script in eight to 10 hours, and he works almost twice that long per day. Hence his unparalleled pace.

In other words, Sheridan has been both the ideas man and the details guy for many of his shows, and it’s far from certain that his special sauce can be synthesized and outsourced. On the other hand, he has delegated much or all of the writing for Mayor of Kingstown, Tulsa King, and Lawmen, and he seems set to hand off many of the showrunning and writing responsibilities for the next wave of Yellowstone spinoffs, which could serve as test cases for the franchise’s viability after he moves on.

4. Sheridan doesn’t lack for confidence.

OK, that’s not a new insight: Just look at how Sheridan tends to center himself in his shows or how he speaks about his creative process. For instance, in a 2023 profile in The Hollywood Reporter headlined “Taylor Sheridan Does Whatever He Wants,” Sheridan said, “I am going to tell my stories my way, period,” and declared, “I won’t compromise.” He hasn’t had to compromise at Paramount, where he became a golden goose even as the cost of his own upkeep increased. Perhaps he won’t have to compromise at NBC, either, but he will be expected to keep laying those lucrative eggs.

NBC is betting that he hasn’t peaked, and Sheridan is betting on that, too. As much incentive as Paramount seemed to have to keep Sheridan in-house, he had his own reasons to stay at a company where he could keep building up his established properties instead of entrusting them to others and starting over from scratch. Perhaps he values the challenge of putting Peacock on the map for more than Love Island USA, just as he put Paramount+ on the map for more than Star Trek. It’s not easy for expensive free agents to justify their price tags and repeat the feats that won them their windfalls. If Sheridan does so, Rhimes would probably be the closest comp: She barely missed a beat after moving from ABC to Netflix. (What does one do for a follow-up to Grey’s Anatomy and Scandal? How about Bridgerton? Boom.)

A second aspirational comp comes to mind, from another realm of entertainment. Theo Epstein won a long-awaited World Series with the Red Sox in 2004, then added another title in 2007. Nonetheless, he left in 2011, having embraced Bill Walsh’s mantra that after 10 years together, both an individual and an employer may benefit from a change.

As Epstein wrote in an op-ed for The Boston Globe, “The executive gets rebirth and the energy that comes with a new challenge; the organization gets a fresh perspective, and the chance for true change that comes with new leadership.” Epstein’s parting with the Sox worked out for both sides: He broke another so-called curse by winning a World Series with the Cubs in 2016, and his old team went on to win championships in 2013 and 2018, thanks partly to his work while in Boston. The equivalent in this case would be Paramount profiting further from the foundation Sheridan erected, while Sheridan delivers new huge hits for NBC.

That’s easier imagined than done. However, it’s not as if Sheridan has been a one-trick pony. On his shows, the ponies perform lots of tricks, and so does he. It would be one thing if Sheridan’s sole success had come in cowboy shows (or the Yellowstone universe, specifically), but he’s branched out into other genres and been met with similarly strong receptions. Virtually everything he has touched on TV has turned to ratings gold.

Granted, it has to have helped that Paramount could promote each new Sheridan show directly to the audience of his old shows, but Yellowstone’s presence on Peacock may help NBC do the same. Provided TV tastes don’t change in a way that hampers his audience, and assuming he doesn’t burn out, empty his well of promising series concepts, or overextend himself (which may have happened already, judging by the quality of, say, Yellowstone Season 5), he could keep churning out TV tentpoles.

Not that engineering more TV hits is his sole goal.

5. Sheridan may make more movies now.

Before Sheridan became a heavy hitter on TV, he was an Oscar-nominated writer of several films, including his “modern American frontier” trilogy of Sicario (2015), Hell or High Water (2016), and Wind River (2017). The last movies with Sheridan-penned scripts to be released were Without Remorse and Those Who Wish Me Dead in 2021, but he hasn’t abandoned his big-screen ambitions. F.A.S.T. (the aforementioned film from Warner Bros. Pictures that Ellison wanted to distribute) is coming in 2027, and he may have hopes of making a movie out of Empire of the Summer Moon, which he optioned in 2024. Sheridan was reportedly miffed that a script of his for a feature called Capture the Flag came back with “extensive notes” from the cochair of Paramount Pictures. (To Sheridan, network/studio notes are a no-no.) That may have contributed to his wandering eye.

NBCUniversal entertainment chairman Donna Langley, who successfully courted Sheridan, controls the company’s film division as well as its TV arm. Her discussions with Sheridan started with his film work before expanding to encompass the small screen. According to Belloni, Sheridan was intrigued by “the creative and lucrative home that Langley has fostered for filmmakers like Steven Spielberg, Chris Nolan, Jordan Peele, and Chris Meledandri.” He’s also “said to have seen in Universal a place where he would be treated like an elite filmmaker while also producing the kind of elevated TV serials for which he has become known.”

I’m not sure how it would be humanly possible for Sheridan to make more movies while also accelerating (or even maintaining) his TV assembly line, but he seems determined to do it. Belloni reports that Sheridan “has long admired TV juggernauts like Dick Wolf and Lorne Michaels, who have produced for NBCU for decades,” and morphing into more of a brand-name TV producer than a hands-on writer-director could free up time for films. So expect more material from Sheridan not only on a streaming service near you but also in a theater near you.

6. Overall deals are endangered, but not dead.

Reduced TV and film production means reduced demand for TV and filmmakers, so as spending in the film and TV industries has dwindled drastically, the money for many creatives has dried up, too. One of the prominent casualties of this trend has been the Peak TV practice of shelling out many millions of dollars to lock up creators to long-term overall deals (which didn’t always work out for the streamers in more prosperous times). Even big names are not exempt from the cutbacks.

Clearly, Sheridan is, even if increased scrutiny of his budgets was one of the developments that drove him into NBC’s arms. A billion-dollar deal for the fabulously successful founder of a TV empire, who may already have approached the three-comma club, will hardly raise the spirits of the many lower-level writers who are struggling to find work—or, for that matter, the thousands of employees Paramount Skydance has laid off since its merger. But it does show that there’s still big money to be made by someone who makes his bosses big money—especially someone who so often works alone, which has earned him a reputation as a TV auteur with a singular, irreplaceable sensibility.

Immunity from downsizing seems to be another way in which the normal rules of entertainment don’t apply to Taylor Sheridan, a one-of-a-kind TV-making machine. His TV tales have taught us plenty about that: The rules rarely apply to his protagonists, either.